All Categories

Featured

Table of Contents

The internal revenue service may, nonetheless, be needed to obtain court consent in the situation of bankruptcy; see 11 U.S.C. 362. An IRS levy on a primary house must be authorized in writing by a government district court judge or magistrate. See Internal Income Code areas 6334(a)( 13 )(B) and 6334(e)( 1 ). Area 6334 also provides that specific possessions are exempt to an internal revenue service levy, such as specific putting on garments, gas, furniture and home impacts, specific books and devices of profession of the taxpayer's occupation, undelivered mail, the section of salary, earnings, and so on, needed to sustain small children, and certain other possessions.

Beginning January 1, 2015, the Mississippi Division of Earnings will register tax liens for unpaid tax obligation financial obligations online on the State Tax Lien Pc Registry. A tax obligation lien tape-recorded on the State Tax Lien Computer registry covers all residential or commercial property in Mississippi.

Profit By Investing In Real Estate Tax Liens

The State Tax Lien Computer system registry is a public website accessible on the net that might be searched by anybody at any kind of time. Unlike tax obligation returns, tax liens are a public notice of financial debt.

For an individual detailed on the State Tax Obligation Lien Windows registry, any kind of genuine or personal effects that the person has or later on obtains in Mississippi undergoes a lien. The lien enlisted on the State Tax Obligation Lien Registry does not identify a details piece of building to which a lien uses.

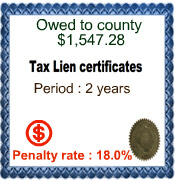

Property Tax Lien Investing

Tax liens are provided on your credit history record and lower your credit score score, which might affect your capability to obtain financings or funding. A tax obligation lien is valid for 7 years unless an extension is submitted prior to it runs out. The continuation extends the lien an additional 7 years. Mississippi legislation enables extensions on state liens until they're paid in full; so continuations can be filed consistently making a tax lien legitimate forever.

The lien consists of the quantity of the tax obligation, penalty, and/ or rate of interest at the time of registration. Enrollment of the tax lien gives the Division a lawful right or interest in an individual's residential or commercial property until the responsibility is completely satisfied. The tax obligation lien may affix to actual and/or personal building wherever located in Mississippi.

The Commissioner of Income sends by mail an Assessment Notice to the taxpayer at his last well-known address. The taxpayer is supplied 60 days from the mailing date of the Assessment Notice to either totally pay the analysis or to appeal the assessment - investing in tax liens online. A tax lien is terminated by the Department when the delinquency is paid completely

Are Tax Liens A Good Investment

If the lien is paid by any various other ways, then the lien is terminated within 15 days. When the lien is terminated, the State Tax Obligation Lien Pc registry is upgraded to reflect that the financial obligation is pleased. A Lien Cancellation Notice is mailed to the taxpayer after the debt is paid completely.

Enlisting or re-enrolling a lien is exempt to management allure. However, if the individual thinks the lien was filed in mistake, the individual must call the Department of Profits immediately and demand that the filing be examined for accuracy. The Department of Earnings might ask for the taxpayer to send documentation to support his claim.

Latest Posts

Tax Property Sales

Do I Owe Property Taxes After Foreclosure

Buying Property Delinquent Taxes